It’s past time to address Minnesota’s dramatic disparities in homeownership and wealth.

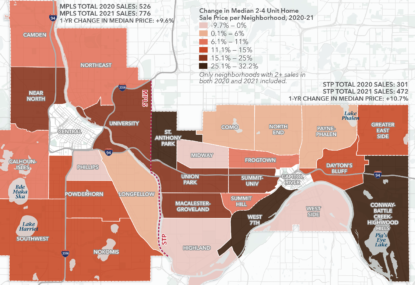

Homeownership is one of the most effective ways for a family to build wealth; the typical homeowner has 36 times more wealth than a renter. Discriminatory policies and practices – such as redlining, racial covenants, restrictive zoning, and predatory lending– have made it difficult for people of color, and especially Black and Indigenous families, to build wealth as homeowners. Nationally, white households have ten times the wealth of Black households. In 2020, 40% of Minnesotans of color and just 25% of Black Minnesotans owned their homes, compared to 75% of white Minnesotans. This 50-point difference between Black and white households in Minnesota represents one of the worst homeownership gaps in the country.

Small multifamily buildings represent an affordable entry to real estate investment and wealth building.

Small multifamily (duplex, triplex, and fourplex) ownership offers a meaningful opportunity to close our racial disparities in wealth. Since they use the same conventional mortgage lending as single-family homes, these properties represent an affordable entry to real estate investment. When a first-time buyer purchases a 2-4 unit building, they can earn additional income from rent, additional mortgage paydown, and additional appreciation. They also have the option to provide housing to their family, friends, and community if they so choose.

But the limited supply of these buildings, frequent repair needs, lack of support for new landlords, and historic wealth gaps make it difficult for low-income households of color to take advantage of this wealth building opportunity. That is why we are piloting a comprehensive strategy to address these barriers, creating a regional model that can inform national practices.

The Building Equity in Small Multifamily Ownership initiative

Program Strategy

With a collaborative of partners, Family Housing Fund led a three-year pilot effort realigning systems to help BIPOC families build wealth as owner-occupant landlords of 2-4 unit buildings in their communities. Our two-pronged approach included:

- Address the constrained supply and high competition for 2-4 unit properties.

- Our collaborative offered acquisition and construction loans to increase the supply of affordable 2-4 unit homes, building a pipeline of properties available for local owner-occupants to purchase. We prioritize loans to local BIPOC developers.

- Our collaborative offered rehab loans to local developers to ensure the existing stock of 2-4 unit housing is in good repair before new homeowners purchase/move in.

- We facilitated sales to homebuyers with the help of community partners.

2. Ensure homebuyers have access to capital and training to become successful homeowners and responsible landlords.

- Our collaborative worked to provide owner-occupant landlord training alongside existing homeownership education programs and in community settings.

- We partnered with Build Wealth Minnesota to increase access to mortgage financing.

- Our collaborative provided forgivable down payment assistance for qualifying homebuyers who have completed owner-occupant training.

- We established post-purchase resources for new owner-occupant landlords, including: 0% interest post-purchase loans for home repairs or improvements, and a matched savings program to help new homeowners build savings.

For a deep dive on each of these program components, read Wilder Research’s evaluation report.

Impact Reports

Our Collaborative

We are grateful to have an amazing core group of partners who have worked with us to develop this concept and are critical to implementing this collaborative strategy: Hope Community, Build Wealth Minnesota, Model Cities, Minnesota Home Ownership Center, Comunidades Latinas Unidas en Servicio (CLUES), Rondo Community Land Trust, Land Bank Twin Cities, and Greater Minnesota Housing Fund. We also thank Center for Energy and Environment (CEE ), Prepare + Prosper, Wilder Research, and our network of referral partners: African Career Education and Resources (ACER), City of Lakes Community Land Trust, Lutheran Social Service of Minnesota, Mni Sota Fund, Neighborhood Development Alliance (NeDA), New American Development Center, NeighborWorks Home Partners, PRG, and Urban Homeworks.

Webinar Materials

Thank you to our funders

In 2020, the Building Equity in Small Multifamily Ownership initiative received a $4 million, three-year grant from the JPMorgan Chase AdvancingCities Challenge to pilot this work in Minneapolis. In 2021, the Bush Foundation generously matched this with another $4 million grant to expand this work to Saint Paul and suburban communities in the Twin Cities metro region. The initiative also receives support from the F.R. Bigelow Foundation, Minneapolis Foundation, Saint Paul & Minnesota Foundation, and individual donors. We are immensely grateful for this generous support.

Related Resources

Small Multifamily Homes & Wealth Building

Duplex Designs for Developers

This program in the news

- Building equity in small multifamily housing (Finance & Commerce, 6/08/22)

- Minneapolis group awarded $4M for equity efforts (Finance & Commerce, 9/22/20)

- Chase Bank’s journey from Wall Street to Ventura Village (Twin Cities Business, 9/22/20)

- JPMorgan Chase celebrates new community branch, $4 million grant for affordable housing (Star Tribune, 9/21/2020)

- Minneapolis receives $4 Million in JPMorgan Chase’s AdvancingCities Challenge as bank showcases new, innovative branch in Ventura Village (JPMorgan Chase, 9/21/20)

- Chase Bank opens branch aimed at helping south Minneapolis community (FOX9, 9/21/20)

- Join the conversation with #BuildEquityMSP and help us create a more equitable Twin Cities region!